How to retire early

This article is how to retire early, based on personal experiences.

My grandmother worked at the same company for 25 years and received a gold watch when she retired. She died at age 61, a year before being eligible for social security.

My mother inherited the watch, worked at the same company for 30 years, and retired. She died at age 63.

I inherited the watch and gave it to an eight year old girl. We set it to the time at that moment, 2:20, and she said, “It’s time to play!” so we went outside and played.

Later, I wrote this article on how to retire early. I wish you success.

what to expect

I combine what it means to retire, philosophically, with resources on how to retire. If you’d like to skip my article, you can learn from these sources:

- The 5 Mistakes Every Investor Makes and How to Avoid Them

- How I Built This

- IRS guide to retirement plans

- Investor.gov

- TreasuryDirect.gov

- Social Security – Office of Retirement

- U.S. patent office – provisional patents

know yourself

Know what it would means for you to retire. It may be more money, it may be more time, it may be changing how you earn your living.

Don’t be biased by someone else’s definition of retirement. Know what works for you, but don’t worry if you don’t know yet. Money and happiness have been debated for all of human history.

Sapiens: a Brief History of Humankind uses thousands of words to say that money doesn’t exist, that we only believe in it. I tried explaining that to my landlord, but he still wanted a rent check.

If you do what you love, you’ll never work a day in your life.

Learn how to love more, and you’ll do more of what you love.

know that nothing is guaranteed

Nothing is guaranteed, especially social security. Today, you are paying for people who are already retired. Eventually, today’s children may pay for your retirement. Or, they may not. Social security is expected to be bankrupt by 2035.

Be kind to all children. Your retirement depends on it.

One of my favorite songs says: “Don’t expect anyone else to support you. Maybe you’ll have a trust fund, maybe you’ll have a wealthy spouse, but you never know when either one might run out.”

Listen to the song, then take steps to retire early.

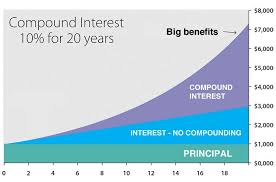

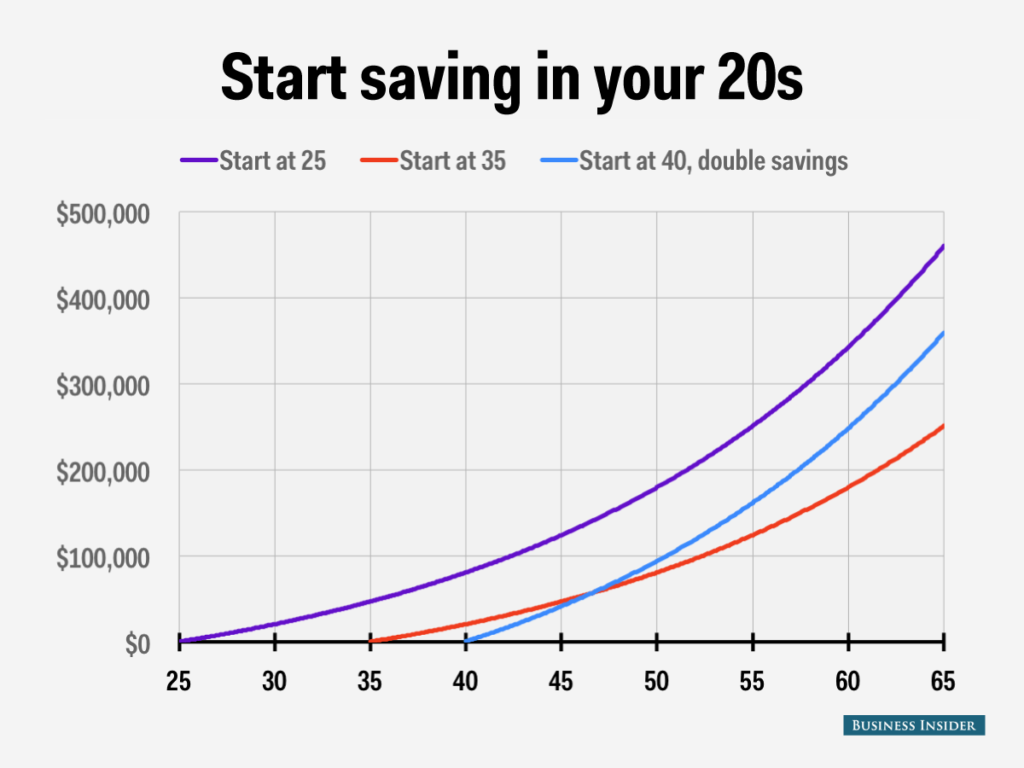

Understand compounding interest

The world’s third wealthiest person, Warren Buffet, said that he owes his wealth to compound interest. He hasn’t worked a day in his life.

Save more

A penny saved is a penny earned. You may have to make sacrifices, delay buying something you want or live in a smaller home, but everything’s a choice.

Invest wisely

A penny invested with compound interest is a dollar earned, and a dollar spent foolishly is a lost opportunity. You can achieve more by investing soon and learning as you go.

You may or may not need a financial advisor or broker. Learn their qualifications and incentives.

This comedy video shares important information about fees of retirement advisors, but it has curse words and references that may not be appropriate for children.

Learn basic investment terms and ensure what you read is time tested, empirically proven facts about investing. I recommend reading The 5 Mistakes Every Investor Makes and How to Avoid Them, and considering what Warren Buffet says.

Start investing simply, then learn by observing. With patience, investing in market indexes like the DOW, NASDAQ, and S&P 500 yields more than the majority of managed funds that charge fees. Learn more about ETF‘s and diversifying your investments.

Market trends may influence your retirement more than individual stocks. You may benefit more from researching oil or airline industries than Exxon or Boeing. When comparing similar stocks within an industry, I recommend understanding at least a few important financial metrics.

- PE and PEG ratios – the price per earnings, a measure of past value, and the PE per growth expectations, an estimate of future value. Understand the criticisms of PEG, compare stocks within the same industry, and make informed choices.

- Debt to Equity Ratio – how a company invests vs. how much it owns, similar to how much you owe in debt vs. how much you own and could sell.

- Free Cash Flow – how efficiently and effectively a company manages monthly or quarterly expenses, similar to if you have more income than expenses at the end of each month. Understand the difference between Cash Flow and Free Cash Flow.

Watch markets go up, and watch markets go down. Watch stocks go up, and watch stocks go down. Watch other investors get excited, and watch other investors become worried. Remain calm, observe, and learn. Everything will be fine.

If you’re employed, take advantage federally approved retirement plans. Most plans give you tax benefits and allow you to invest up to 30% of your salary, limiting it to approximately $17,500, and many employers match your contributions. Remember compound interest; start contributing to your retirement plan soon.

Open an Individual Retirement Account with your bank, either a Roth IRA or a Traditional IRA, even if you already have a retirement plan. Invest in it, learn, and improve. Even without trying, the tax benefits are worth opening an IRA. If you would have paid 27% in income tax, the tax benefits of an IRA are like earning 27%.

You can decide who inherits your IRA after your death, and this decision bypasses the long legal process of settling your estate, and is not part of your last will and testament therefore can not be disputed.

Retirement plans are transferable between employers and banks. You can withdraw most retirement accounts without penalty for medical emergencies, and sometimes for first time home purchases. Your retirement account is protected from bankruptcy claims, which is useful for entrepreneurs wanting to take calculated risks.

If you’re self employed or an aspiring entrepreneur you won’t have access to an employer’s plan. Our government only allows you to invest $5,500 per yer in an IRA. If that frustrates you, write a letter to explain why to your senator or congressperson, then focus on improving your business or entrepreneurship skills.

You can invest in stocks and bonds, and you can also invest in yourself and the relationships that make retiring worthwhile.

INVEST IN EDUCATION

Consider buying series EE savings bonds or other education-beneficial investments as soon as possible. They grow interest – though not much – and when cashed the earnings are not taxed if used for education costs.

Use stock market simulators to practice investing. Consider practicing with other people; it’s like a fantasy football league, but with investing for your future.

Learn with kids. Consider games that include math, financial concepts, and the effects of choices. Instead of giving them spending money, give them earning opportunities. Investigate apps, cards, and bank accounts that help them manage money with your supervision or oversight. Lead by example and continuously improve yourself.

College isn’t for everyone, and student loans can be crippling. Google, Apple, and many other tech companies don’t require college degrees, they require knowledge you can obtain for free from the internet. College is like investing, a financial risk that should be a clearly defined step towards a long term goal.

Choose wisely, based on your goals and financial means. The internet and public libraries have free ways to learn.

set goals, plan, & IMprOVE

Start with the right intention; set a goal to retire, whatever that means for you. Put forth effort each day. Your effort will be easier when big goals are broken into smaller steps. If you love the process, the effort is effortless.

I can’t tell anyone how to plan effectively – you must learn what works for you – but know that even the best plans can fail. Don’t be attached to plans; remain focused on goals.

Explore entrepreneurship

Be a part-time entrepreneur, or commit to a goal full time, or learn enough to know that entrepreneurship isn’t for you. Live without regret.

Sara Blakely, a self-made billionaire who invented and patented Spanx leggings for women, started her business with a few thousand dollars and help from other people. She did this part time. The same is true for Lara, who worked in food retail before retiring as a millionaire, a few years after her first prototype LaraBar.

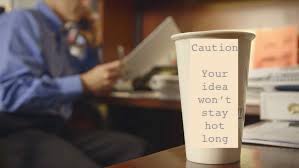

A provisional patent costs $100; don’t delay filing patents for your ideas. A good idea today is better than the perfect idea tomorrow.

Entrepreneurs are persistent and have help from other people. If you’re an aspiring entrepreneur, be kind to everyone and practice active listening.

Continuously improve

Have a goal and a plan, but do not be attached to that plan or to that goal. Set time aside to access your original goal and plan. If necessary, modify your plan or your goal. If all else fails, revisit what retirement means for you.

Give back

With college degrees becoming less important, what we do with our free time becomes more remarkable. You get what you give. Spend more quality time with your family, invest in deeper relationships and friendships, or volunteer in your community.

Do less

I’ve been lucky. Most people have had less luck, through no fault of their own. I wish them happiness.

Throughout my life, the kindness of others has helped me more than anything I’ve done on my own, and meditation has helped me be happier by doing less. I’m happy sharing my lessons with others. I wish you success.

Fill your bowl to the top and it will spill.

Keep sharpening your knife and it will dull quickly.

Chase after money and you will never have enough.

Care about people’s approval and you will always need more.

Do your work, then retire. That’s the only path to serenity.

– The Tao Te Ching